Larry Li’s VC Boom Began with Zoom

By James Moreau | 13 Jun, 2025

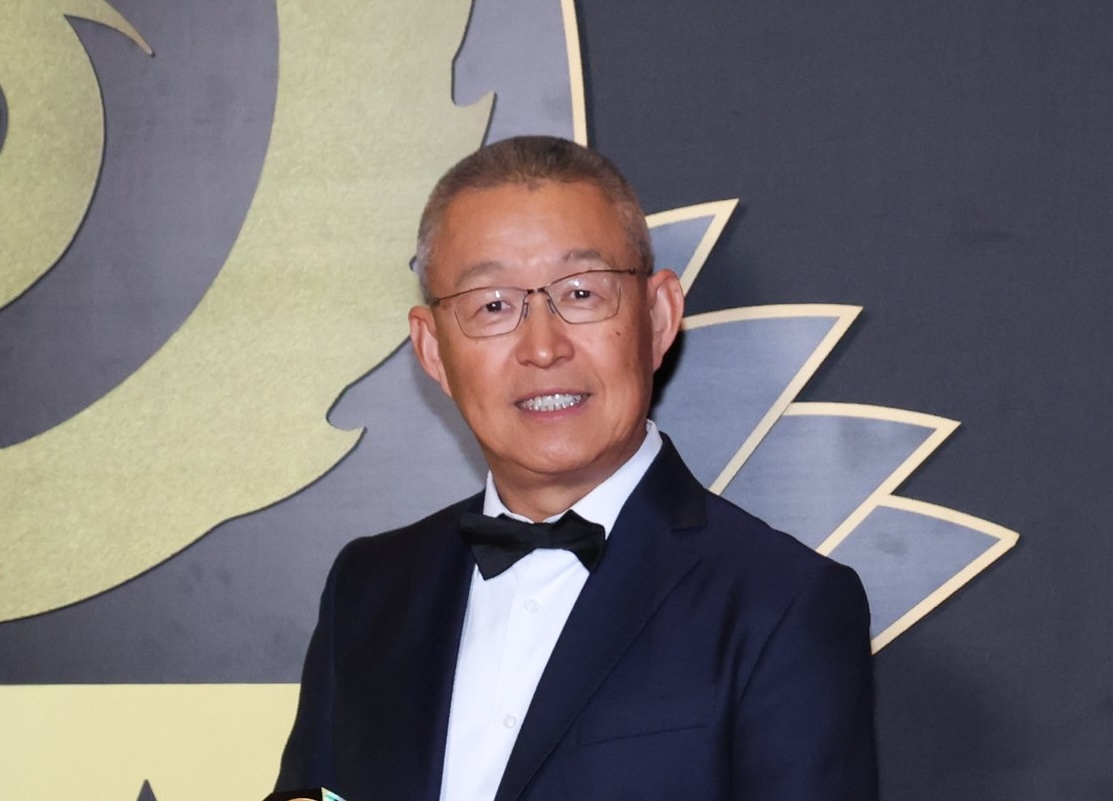

Spotting 15 unicorns and counting, Larry Li, a managing partner at Amino Capital has demonstrated a remarkable ability to identify and nurture high-growth startups.

Venture capitalist Larry Li has an exceptional ability to spot high-potential early-stage companies. The Founding and Managing Partner of Amino Capital spots potential market growth by identifying technology gaps and analyzing social and political trends likely to enhance product demand.

The 61-year-old made his mark in early 2011 by co-founding an angel fund that invested in Zoom. It wasn’t until six years later that it achieved a $1 billion valuation. As of its April 2019 IPO it had reached $17.7 billion. At the height of the pandemic it hit $161 billion. Today the market cap is at $23.5B, a far cry from its nascent quest to raise $3 million in seed money.

Li’s keen eye has spotted over 15 unicorns or privately held startups that have achieved valuations exceeding a billion dollars. Since its founding in 2012 Amino Capital has invested primarily in the tech sectors of AI, software as a service, also known as SaaS, and decentralized blockchain-based finance, aka Web 3.0. This strategy has boosted its assets under management to over $1 billion, spread across investments in over 160 companies.

Li’s Amino was one of the first to invest in Chime, the largest digital bank in the U.S. The 2013 seed round raised $3.8 million in capital when its valuation was still in 7-figures. It reached unicorn status in March 2019. On Thursday, June 12, 2025, Chime became listed on Nasdaq with a $17.1 billion valuation at $40 per share — 48% above its $27 IPO price.

Other big seed-stage wins include the website builder Webflow and business software Rippling, with $4- and $11 billion valuations respectively.

Li’s strategic investments have also led to noteworthy exits, including Assemblage acquired by Cisco in 2014, Orbeus acquired by Amazon in 2015, and Ozlo acquired by Facebook in 2017. These paydays helped Amino Capital’s reputation while the liquidity provided reinvestment capital.

Li has authored two books, “The Logic of Investment” published in 2023, which delves into fundamental investing principles and strategies, and in 2024, “VCDemystified” which breaks down the complexities of the venture capital world.

A native of Tianjin, China, Li completed his bachelor’s in engineering from Beijing’s Tsinghua University in 1987 and a MS from Tsinghua University in 1990. He came to the U.S. to attend the University of Florida completing a master’s in electrical engineering in 1993.

Before becoming a VC Li worked in tech, where he developed a data warehouse for Wachovia Bank, now Wells Fargo, managed the software life cycle at Veritas Technologies, and was Chief Architect for the former social commerce site Lockerz where he scaled up its cloud computing infrastructure.

Asian American Success Stories

- The 130 Most Inspiring Asian Americans of All Time

- 12 Most Brilliant Asian Americans

- Greatest Asian American War Heroes

- Asian American Digital Pioneers

- New Asian American Imagemakers

- Asian American Innovators

- The 20 Most Inspiring Asian Sports Stars

- 5 Most Daring Asian Americans

- Surprising Superstars

- TV’s Hottest Asians

- 100 Greatest Asian American Entrepreneurs

- Asian American Wonder Women

- Greatest Asian American Rags-to-Riches Stories

- Notable Asian American Professionals